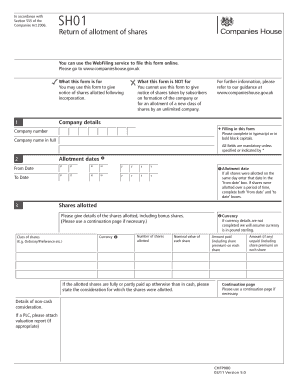

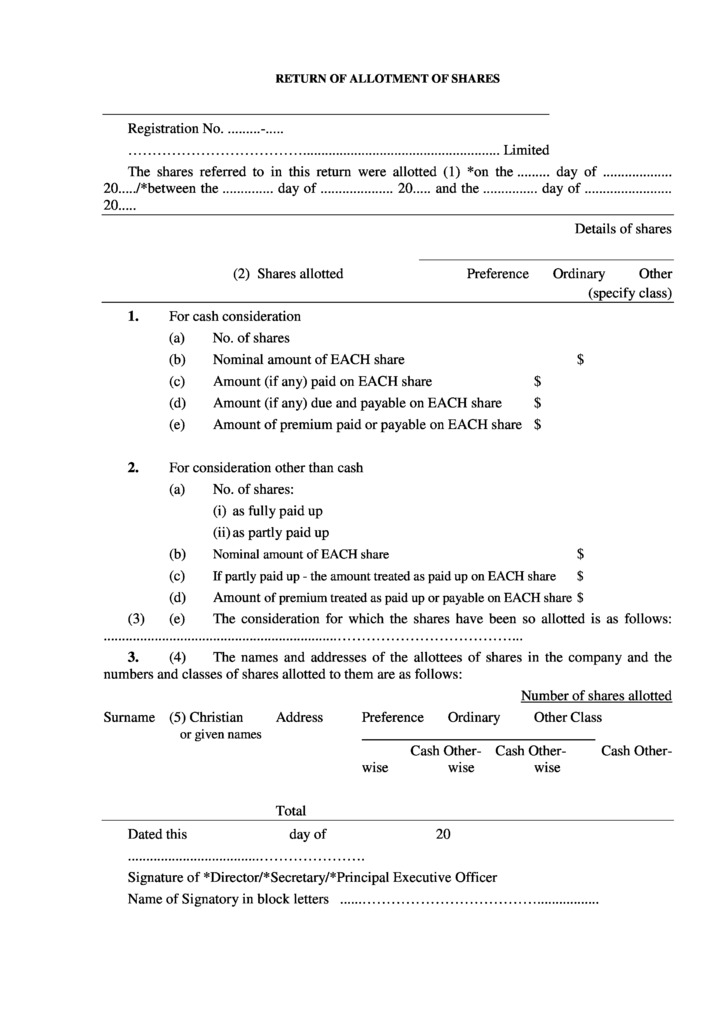

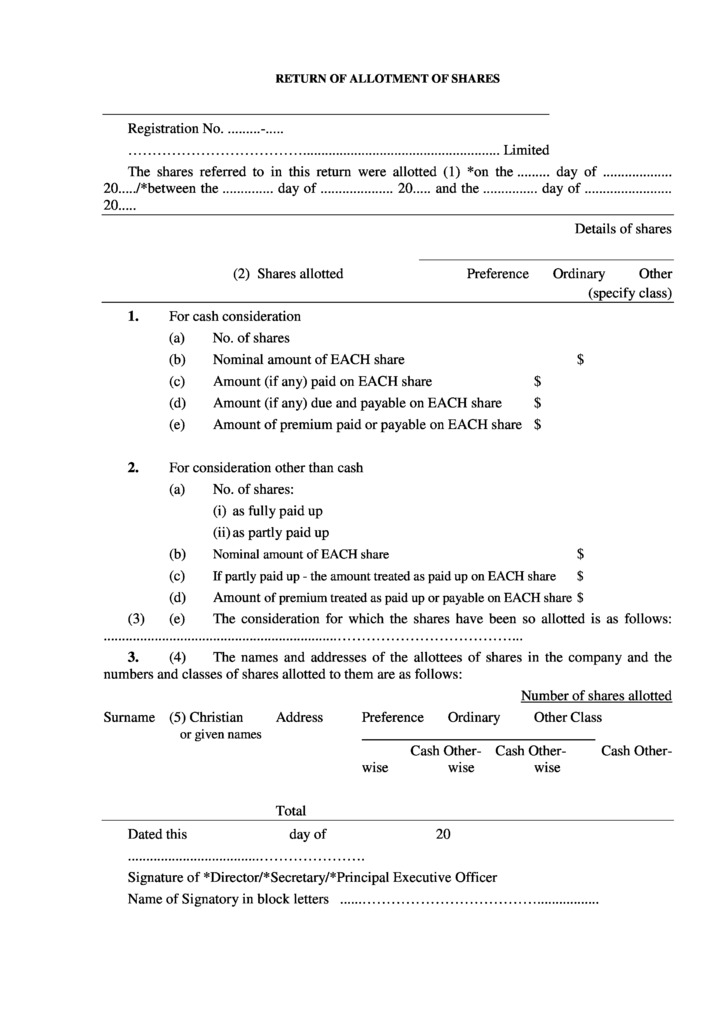

Form 24 consist of the latest amounts details of authorised capital paid-up capital of a sdn. Return of allotment which should be lodged by the company with the Registrar within 14 days from the date of allotment section 78 of the Companies Act 2016.

Fillable Online Sh01 Return Of Allotment Of Shares Gov Uk Fax Email Print Pdffiller

Form 24 Return of Allotment of Shares.

. Acceptance of deposits from public by certain companies. The name of the shareholder who is to receive these shares is not named until. Provide the supporting document Bank-in slip and Bank Statement to secretary 3.

Section 241 of the Companies Act 2016 comes into operation on 15 March 2019. When there are new shares being allotted this Return for Allotment of Shares Section 78 document have to be submitted to SSM. Section 78 Return of Allotment of Shares all Section 105 need to be read together with all Form 24.

Form 24 Return of Allotment of Shares. Return for allotment of shares. Annual return by company having a share capital.

The Board and Members resolution and relevant documents will be signed by the Directors and Shareholders4. Here are the companys information update services offered through MyCoID 2016. Public companies limited by shares can allot new shares.

The first step towards raising money for a company is done by issuing the shares. It contains the particulars of the new shareholder along with the share type share class share price and numbers of share being issued. Private companies can allot new shares only after filing the Return of Allotment of Shares transaction via BizFile.

The form needs to be submitted to SSM for registration once the allotment were approved by the directors existing shareholders. CA 1965 CA 2016. Section 78 Return of Allotment Return of Allotment of Shares 7 30052022 Update register of Members for any.

Applications must be submitted online. Let us see the provisions of Companies Act related to the issue and allotment of securities. Return of Allotment of Shares Section 78 Registers of Members Section 51 Notification of Change in Registered Address Section 46.

Right issue with the boards permission a company can allot shares to the existing shareholders about their previous shareholdingsHowever the offer to the shareholders shall remain open for more than 15 days but less than 30 days. Such allotment of new shares increases the companys share capital. Form 9 Certificate of Incorporation of Private Company.

Notification to the Registrar of the changes in the particulars of the register of members of the company within 14 days of the changes section 51 of the Companies Act 2016. 58 2362 Notification of Appointment of First secretary. The Return of Allotment of Shares is the process of adding new shares into a company.

Issue of shares at a premium. Prohibition of allotment unless minimum subscription received. The company has to submit a copy of the prospectus to.

Share certificate issued under the common seal of the company specifying the shares held by any person shall be prima facie evidence of the title of person of such shares. To file the Annual Returns and Financial Statements in accordance with the provisions of the Companies Act 2016. Form 24 is used to allot new shares to shareholders of a sdn bhd company.

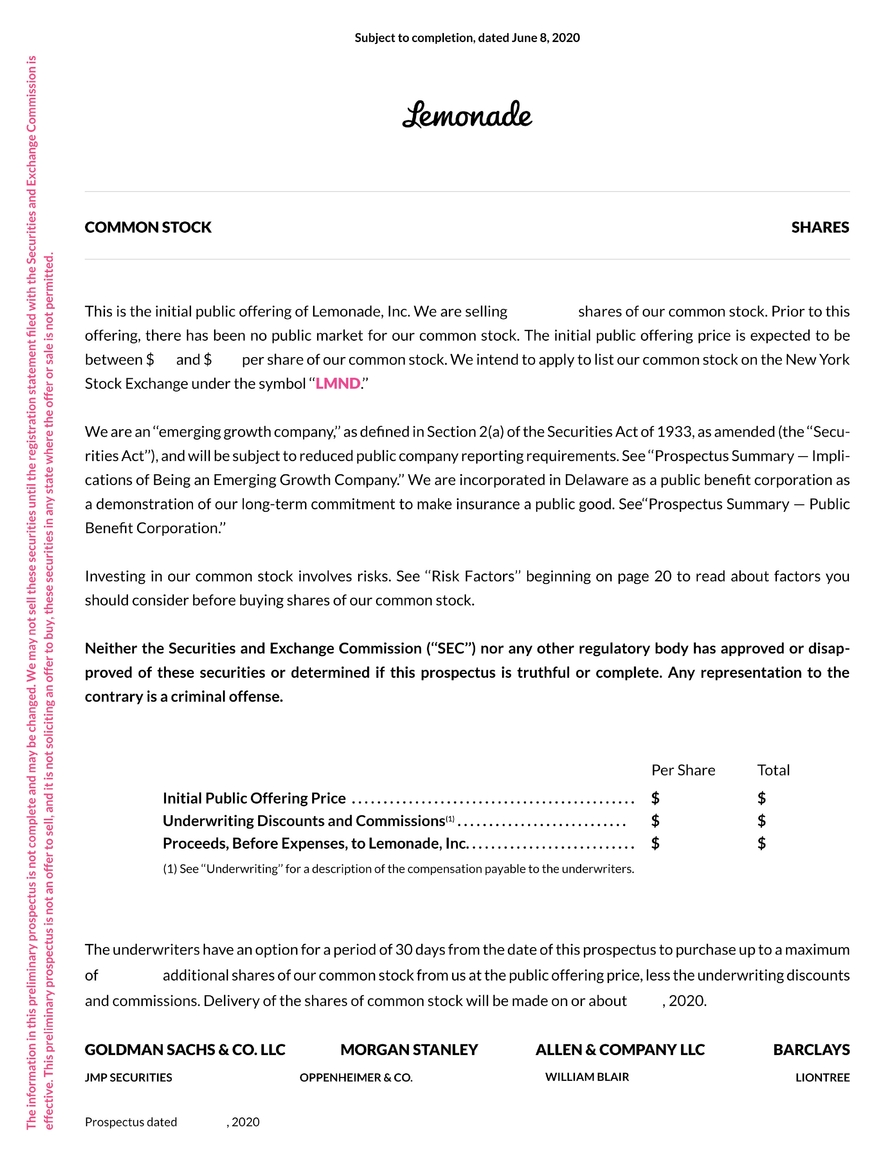

For example a company formed with 1 share can complete a Return of Allotment of Shares also known as the SH01 form and increase the number of shares to a new amount. 203167 6721 578512270172656 rgjlqj5hihuhqfh1xpehu 52 5hjlvwudwlrq1r. Section 76 Allotment of shares or grant of rights with company approval Notice of Approval Allotment of Shares or Grant of Rights 6 30052022 Lodge with Registrar a return on allotment of shares within 14 days from allotment date.

Secretary need to lodge the Return of Allotment of Shares Section 78 and. An allotment of shares is when a company issues new shares in exchange for cash or otherwise. Members must deposit the money capital amount into companys bank account2.

Section 15 Notice of Registration. Section 14 Application for Registration of a Company. As per sections 42 and 62 of The Companies Act 2013 a company can proceed with the process of share allotment in a few ways.

Section 241 of the Companies Act 2016 comes into operation on 15 March 2019. Powers of trustee to apply to the Court for directions etc. Section 17 Application for Registration of a Company.

Section 78 Return for Allotment of Shares Similar to previous Form 24. A Prospectus is an invitation to the public for the purchase of shares in the company.

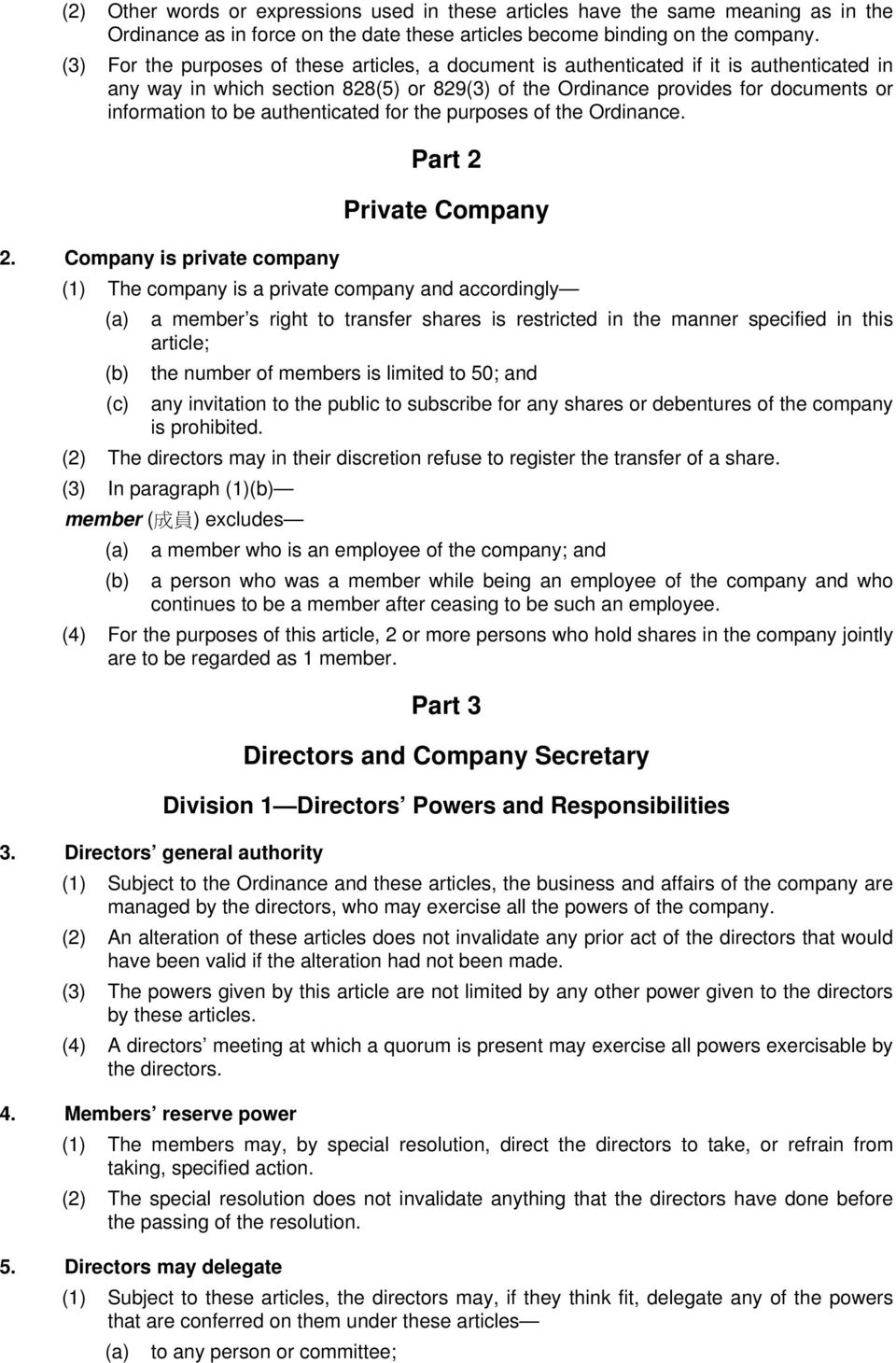

Explanatory Notes To Sample B Model Articles Of Association For Private Companies Limited By Shares Pdf Free Download

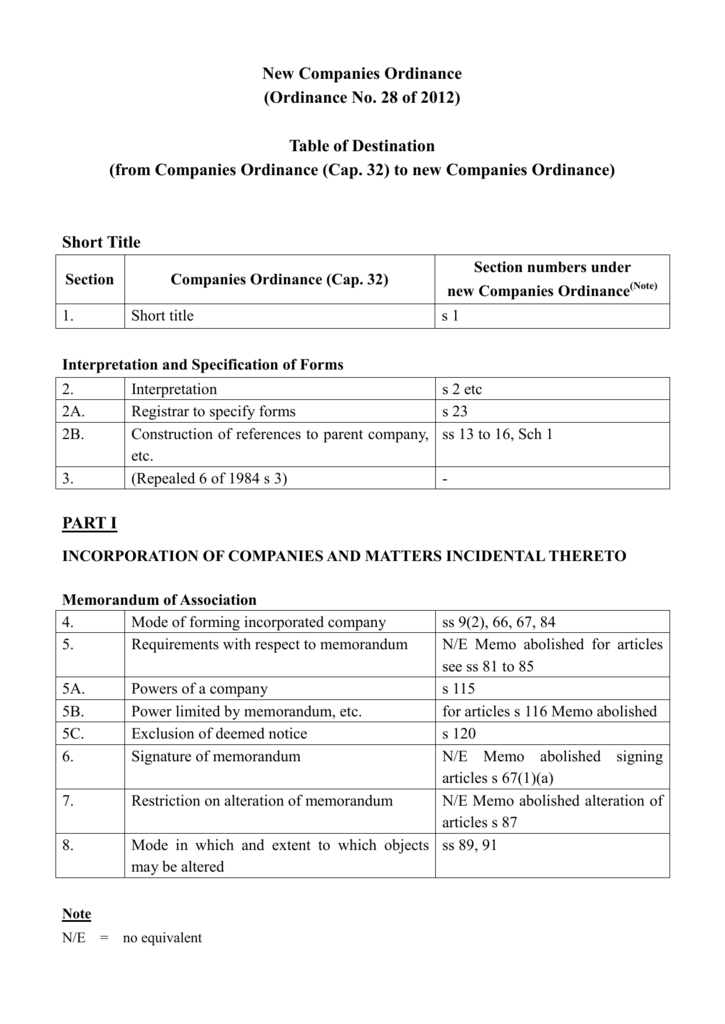

Cap 32 To New Companies Ordinance Table Of Destination

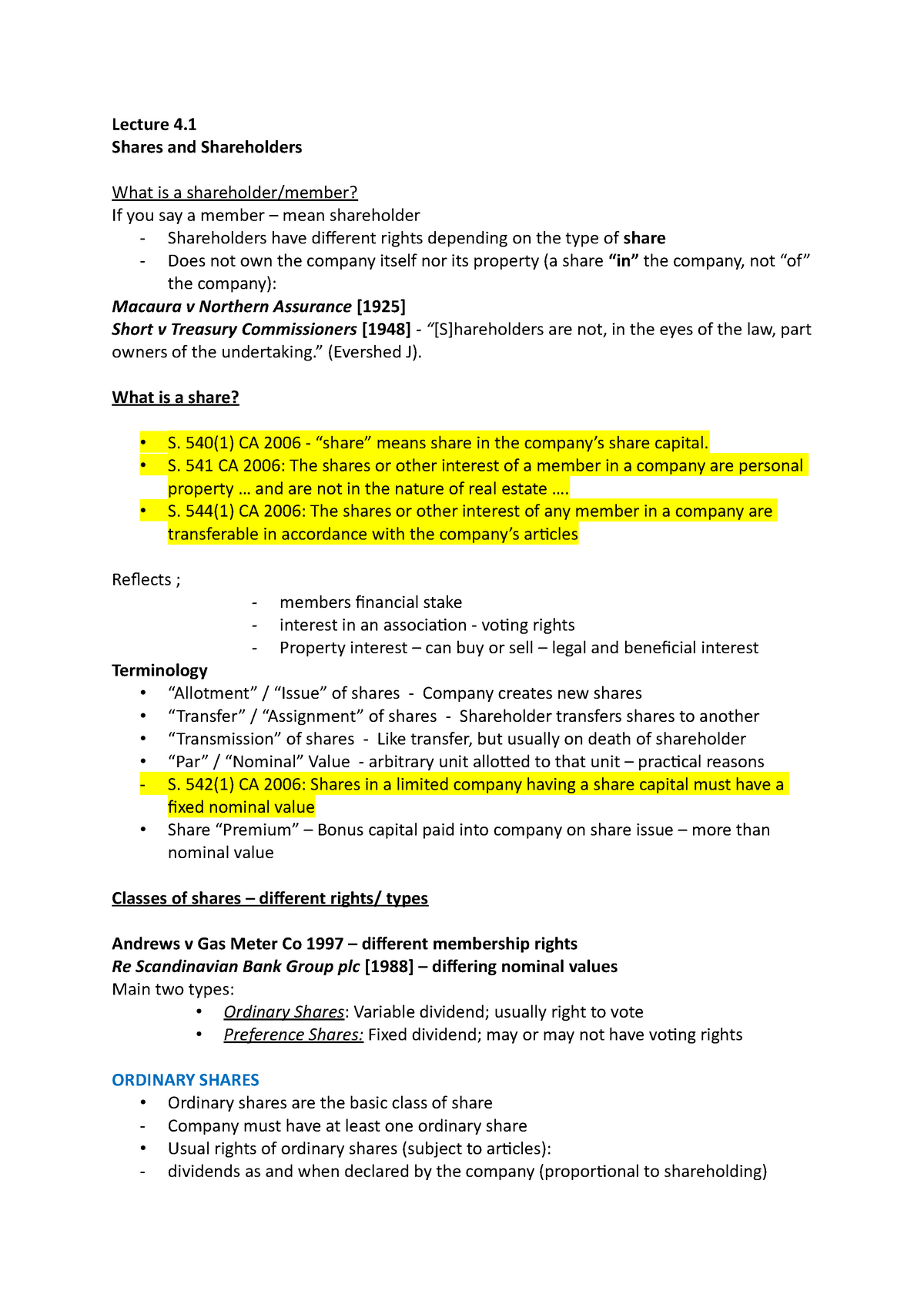

Shareholders Directors And Decision Making Lecture 4 Shares And Shareholders What Is A Studocu

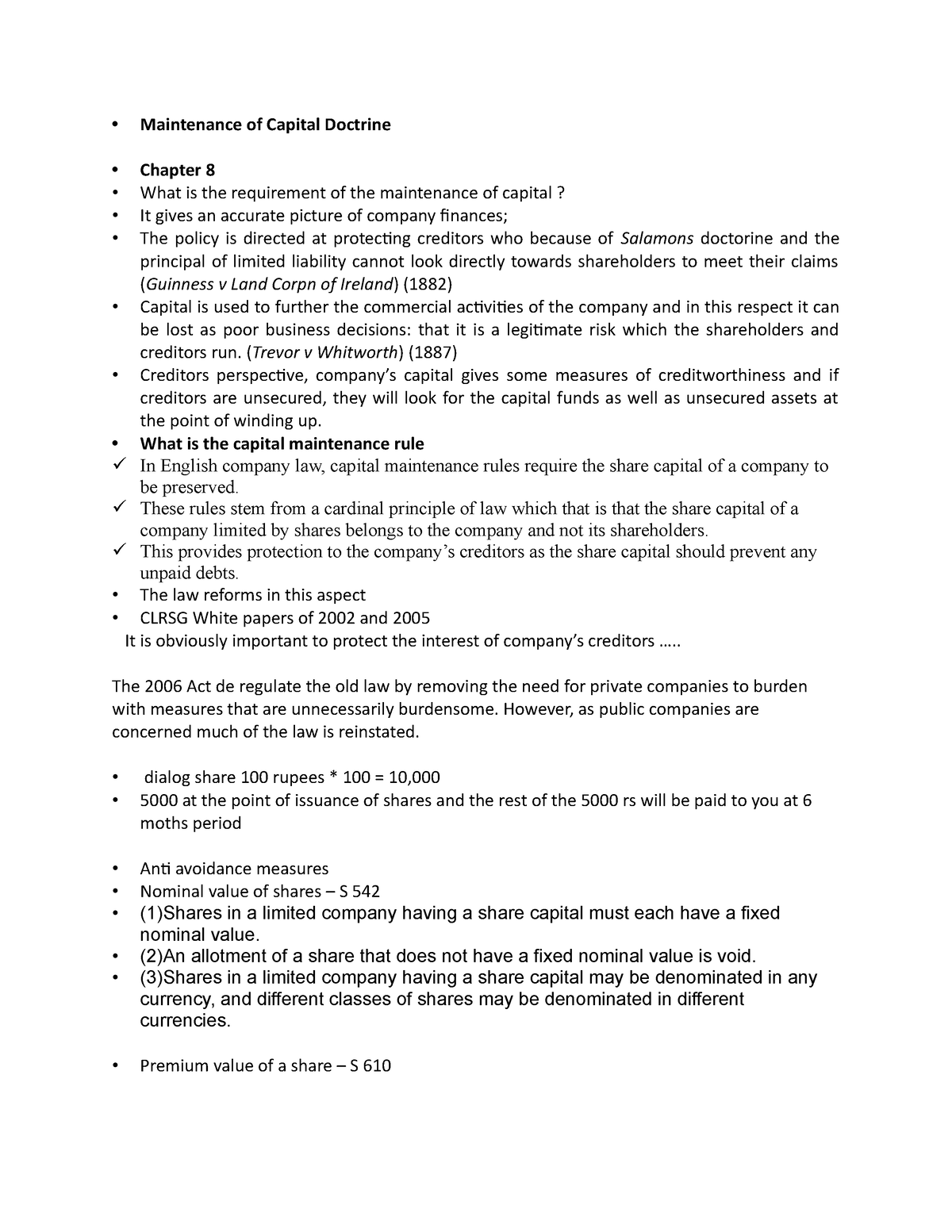

Maintenance Of Capital Doctrine Trevor V Whitworth 1887 Creditors Perspective Company S Studocu

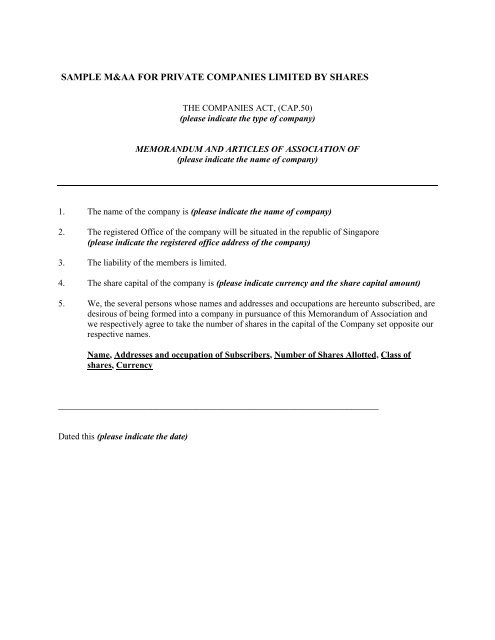

Sample M Amp Aa For Private Companies Limited By Shares Acra

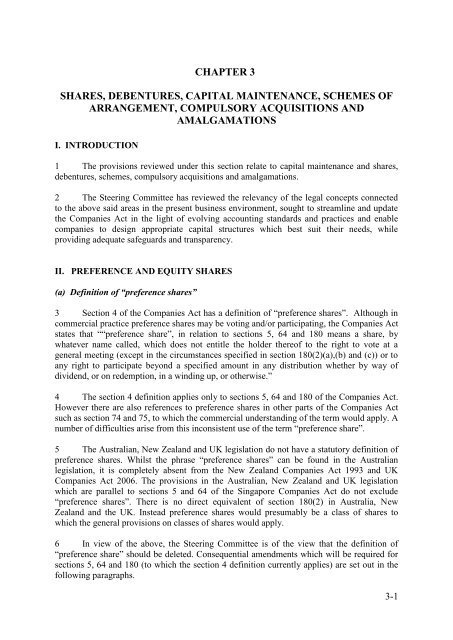

Chapter 3 Shares Debentures Capital Maintenance Acra

Sample M Amp Aa For Private Companies Limited By Shares Acra

Company Registration In Norfolk Island Business Starting Setup Offshore Zones Gsl

Form 24 Return Of Allotment Of Shares Company Registration In Malaysia

What Is The Return Of Allotment Of Shares

Chapter 3 Shares Debentures Capital Maintenance Acra